From widespread project delays and cancellations to disruption of ongoing projects, 2020 has been one for the books for the construction industry. No doubt, year-end tax strategies may be the last thing on your mind as your construction business prepares for an uncertain 2021.

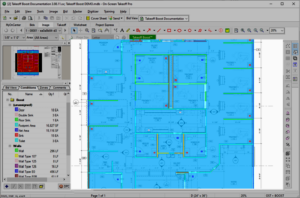

But with more contractors bidding on fewer projects and project backlogs slipping, contractors of all sizes are having to bid more to win more profitable projects. Any possible competitive advantage will be needed in the coming year—including making sure you have the right takeoff and estimating software to ensure speed and accuracy.

The good news is under the Tax Cuts and Jobs Act (TCJA), small- to medium-sized contractors can again deduct up to $1,040,000 on the purchase of new software or equipment before the end of 2020 under Section 179. Purchasing new software for your construction business—or adding new licenses—could be a savvy, year-end tax move.

As always, construction workers can deduct everything from safety boots to mileage to the cost of association dues. For contractors considering adding new software you can deduct, these tax-saving moves will need to occur before the clock strikes midnight on Dec. 31st.

Understanding Section 179 of the Tax Code

First introduced in 2008, Section 179 was part of a stimulus plan designed to provide tax relief to small businesses. In 2018, Congress opted to double-down and increase the previous $500,000 deduction to $1 million. Also called first-year expensing, Section 179 is a write-off for purchases in the year you buy and place the equipment in service.

This means construction businesses can write-off the entire purchase cost in the year it is purchased. As long as the software or equipment is bought and put into service by December 31, 2020, it can be taken as a tax deduction. This includes software, office furniture, printers, and other devices.

It is interesting to note that the National Federation of Independent Business (NFIB) reported that 63% of small businesses made capital outlays on equipment in January 2020. In that case, it makes sense to make these tax-saving moves before the end of the year—instead of at the start of 2021. Whether you’re buying software for the first time or upgrading your software, you may want to go ahead and take advantage of this tax break now.

Closer Look at Fine Print

One of the many advantages of Section 179 of the U.S. Tax Code is that—unlike with regular depreciation—you don’t have to reduce your deduction if you make qualifying purchases late in the year.

Ready to trim your tax bill? Here are a few more facts to note about the Section 179 deduction:

- You can only write off the amount that you spend on qualified purchases. Spend $1 million and deduct $1 million. Spend $10,000, write off $10,000.

- The “phase-out threshold” is $2.5 million. This means a business can spend up to that amount in total equipment before the $1 million limit begins to be reduced dollar for dollar.

- You can’t deduct more than your profit. If your business only has $100,000 in profits, you can only deduct $100,000.

- Your purchases like software must be used for business purchases more than 50% of the time to qualify for the deduction.

Understanding Bonus Depreciation

While Section 179 may seem straightforward, you should also know there is bonus depreciation, which was scheduled to drop from 50 percent in 2017 to 40 percent in 2018. It was increased to 100% for the 2018-2022 tax years.

The main difference is that it now applies to both new and used equipment. This is a change from previous years where bonus depreciation only covered new equipment. Tax experts point out that bonus depreciation is helpful for larger businesses that spend more than the Section 179 spending cap of $2.5 million on new capital equipment.

You can even see how you’ll save by checking out this Section 179 calculator available on Section179.org

Construction Poised for Economic Rebound

You already know that construction is a major contributor to the U.S. economy. Remember that the industry has more than 680,000 employers with more than 7 million employees and creates nearly $1.3 trillion worth of structures each year, according to the Associated General Contractors of America (AGC).

If anyone can lead the way to help the economy return stronger than ever, it is construction. Whether it is the expected demand in the education and healthcare sectors or a pending infrastructure package, contractors should feel some cause for optimism in 2021.

For many contractors, the bottom-line on Section 179 is that it allows them to write off an entire purchase in the first year and reduce their net income and trim taxes. Rather than having to spread out the deduction over a normal five-year depreciation schedule, you can continue to write off the entire cost in the year the purchase is made.

Let’s face it, a potential $1 million tax deduction is exciting. The win-win is that this deduction is specially designed to boost profits. By deducting the full cost of these expenses, you can substantially lower the amount paid for equipment or new software.

Now that you know that investing in estimating software can save on your taxes, why not get started now with a free trial? It’s quick and easy to request a 14-day, risk-free trial. You’ll still have plenty of time to lock in your tax savings.

*This program does not assume your company will qualify to take advantage of IRS Section #179. Please consult your tax advisor or accountant for additional information. Software must be purchased and placed in service by 12/31/2020.