Are you thinking 2021 may be busier and less chaotic than 2020? It may be a great time to add new software, like takeoff and estimating tools, or new equipment and deduct all of it on this year’s taxes.

Call it a win-win for small-to-medium size businesses, Section 179 of the U.S. Tax Code allows businesses—including those who make their living in construction—to expense $1,040,000. After $2,590,000, the benefits of the deduction begin to phase out as the deduction is designed to benefit small and midsize businesses instead of large corporations.

The only catch—you must purchase and start using it before the clock strikes midnight on Dec. 31, 2020. To help you get your arms around the ins and outs of this tax break—we pulled together some FAQs.

Here are 10 more things construction pros should know when claiming their Section 179 tax deduction:

1. How much can I write off?

You can only write off the amount you spend on qualified purchases. For example, if you spend $10,000, you can write off $10,000. Also, you can’t deduct more than your profit. If your business only has $100,000 in profits, you can only deduct $100,000.

2. Is there a “phase-out threshold”?

Yes, it is $2.5 million. This means a business can spend up to that amount in total equipment before the $1 million limits begin to be reduced dollar for dollar.

3. Are there any other rules to be aware of?

Yes, your purchases like software must be used for business purchases more than 50% of the time to qualify for the deduction.

4. How much can I save on my taxes this year?

It depends on how much qualifying equipment and software you purchase and put into use this year. This Section 179 Calculator can show your expected tax savings.

5. What sort of equipment qualifies?

Most tangible business equipment, both new and used, qualifies. The equipment listed below must be purchased and put into use between January 1 and December 31 of the tax year you are claiming. It can be new, used, purchased, leased, or financed:

• Equipment (machines, etc.) purchased for business use

• Tangible personal property used in business

• Business vehicles with a gross vehicle weight in excess of 6,000 pounds

• Computers

• Computer “off-the-shelf” software

• Office furniture

• Office equipment

• Property attached to your building that is not a structural component of the building

• Partial business use (equipment that is purchased for business use and personal use: generally, your deduction will be based on the percentage of time you use the equipment for business purposes).

• Certain improvements to existing non-residential buildings: fire suppression, alarms and security systems, HVAC, and roofing

6. What software qualifies?

For basic eligibility, the software must be “off-the-shelf,” meaning it has not been substantially modified and is available for purchase from the general public. It must also meet all the following general specifications:

• Purchased or financed with specific qualifying lease or loan

• Used in your business for income-producing activity

• Have a determinable useful life

• Must be expected to last more than one year

7. What are Section 179 non-qualifying property?

Most normal business equipment will qualify. Here are some examples of the property and equipment that will NOT qualify:

•Real property like land, buildings, permanent structures, and the components of the permanent structures, including paved parking areas and fences

•Property used outside the United States

•Property that is used to furnish lodging

•Property acquired by gift or inheritance, as well as property purchased from related parties

•Any property that is not considered to be personal property

8. How long do I have to purchase?

Section 179 always expires at midnight, December 31st. To take advantage of Section 179 this year, you must buy (or lease/finance) by December 31, 2020.

9. Can I use Section 179 every year?

Yes, Section 179 can be used every year. It was made a permanent part of our tax code with the Protecting Americans from Tax Hikes Act of 2015 (PATH Act).

10. What’s the difference between Section 179 and Bonus Depreciation?

Bonus Depreciation is taken after the Section 179 deduction is taken, which is helpful for very large businesses spending more than their Section 179 spending limit. Also, businesses with a net loss in a given tax year qualify to carry-forward the Bonus Depreciation to a future year. When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation—unless the business has no taxable profit in the given tax year.

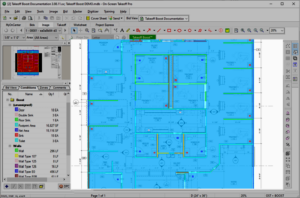

Demo Before You Buy

Now that you know that investing in takeoff and estimating software can help you save on your taxes, why not get started with a free demo? Let our demo specialists show you how to bid and win more work in a fraction of the time.

*This program does not assume your company will qualify to take advantage of IRS Section #179. Please consult your tax advisor or accountant for additional information. The software must be purchased and placed in service by 12/31/2020.